Welcome to the EBITDA Calculator — your reliable online tool to calculate Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) quickly and accurately.

This calculator is designed specifically for Irish businesses, accountants, investors, and finance professionals who want to assess a company’s operating profitability and financial performance. For more business and accounting resources, explore our

Financial Analysis Calculators section.

What is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.

It’s a key financial metric used to evaluate a company’s core operating performance without the effects of financial structure, tax environment, or non-cash expenses like depreciation and amortization.

In simpler terms, EBITDA shows how much profit a company makes purely from its operations, before accounting for financing and accounting decisions.

It’s widely used by investors, analysts, and lenders to compare profitability between companies and industries.

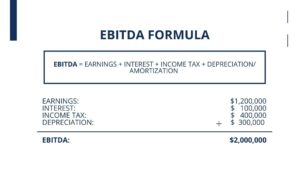

Formula:

[EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization]

You can also go through - Diageo Share Price Calculator

How the EBITDA Calculator Works

Our free online EBITDA Calculator for Ireland applies the standard accounting formula used globally by finance professionals.

When you enter your company’s net income, interest, taxes, depreciation, and amortization, the calculator instantly computes your EBITDA value.

This figure helps you:

- Understand your company’s operating profitability

- Compare performance with industry benchmarks

- Evaluate investment opportunities or lending risks

- Simplify financial analysis during mergers or funding rounds

How to Use the EBITDA Calculator

- Enter Net Income (€) – Input your company’s total net income after all expenses.

- Add Interest (€) – Include any interest expenses paid on debt.

- Add Taxes (€) – Enter total tax expenses.

- Add Depreciation (€) – Include depreciation of fixed assets.

- Add Amortization (€) – Enter amortization of intangible assets.

- Click “Calculate EBITDA” to get your result instantly.

The calculator will display your EBITDA amount in euros (€). You can use this figure to compare profitability or include it in detailed financial reports.

Why Use Our EBITDA Calculator?

✅ Accurate & Instant Results – Get real-time EBITDA calculations using a proven formula.

✅ Ireland-Specific Tool – Designed for Irish businesses, startups, and accountants.

✅ Simple & User-Friendly – No spreadsheet formulas or complex accounting required.

✅ Free & Online – Access from any device, anytime, without signup.

✅ Great for Analysis – Ideal for performance comparison, investment evaluation, and cash-flow planning.

Frequently Asked Questions (FAQs)

1. What does EBITDA tell you about a company?

EBITDA shows how much profit a company generates from its operations before subtracting interest, taxes, and non-cash expenses. It highlights operational efficiency.

2. Why is EBITDA important for investors?

Investors use EBITDA to compare profitability between companies and assess their ability to generate cash from core business operations.

3. Is EBITDA the same as profit?

No. EBITDA excludes interest, taxes, depreciation, and amortization — making it higher than net profit. It’s a measure of operating performance, not total profit.

4. How can EBITDA help Irish businesses?

It helps Irish business owners and SMEs evaluate their performance, determine valuation, and plan financing or investment decisions.

5. Can EBITDA be negative?

Yes. A negative EBITDA indicates the business’s operating expenses exceed its operating income, signaling inefficiency or early-stage losses.